A credit report that focuses on simplicity

In 2022, McAfee found a need to protect users against identity theft and stay competitive by introducing a credit monitoring service. I was tasked with designing the credit report for McAfee's responsive web app.

Duration

3 months

Stakeholders

9

Affected users

+1 million

The team

I collaborated with a Senior Designer, TransUnion partners, Product Managers, a Content Writer, UX Researchers, Product Marketing, and Developers.

Users find their credit report confusing

The problem

We interviewed five McAfee customers to understand their perspective on credit reports and uncovered two primary issues:

The credit report layout most competitors use is too overwhelming.

They do not understand the importance of reviewing their credit report.

Our persona

We designed for a primary persona, Sam, who values simplicity, trusts subject matter experts, and is highly motivated to protect her finances.

User interviews

10

Competitive analyses

3

Wireframes and a design system helped us move quickly

Three rounds of wireframes were reviewed by design leaders, product managers, and engineers to ensure our solution was user-friendly and technically feasible.

Caption

Caption

Caption

Main challenges

Ensuring that the credit report was both comprehensive and easy to understand.

Designing a solution that worked within TransUnion's API limitations.

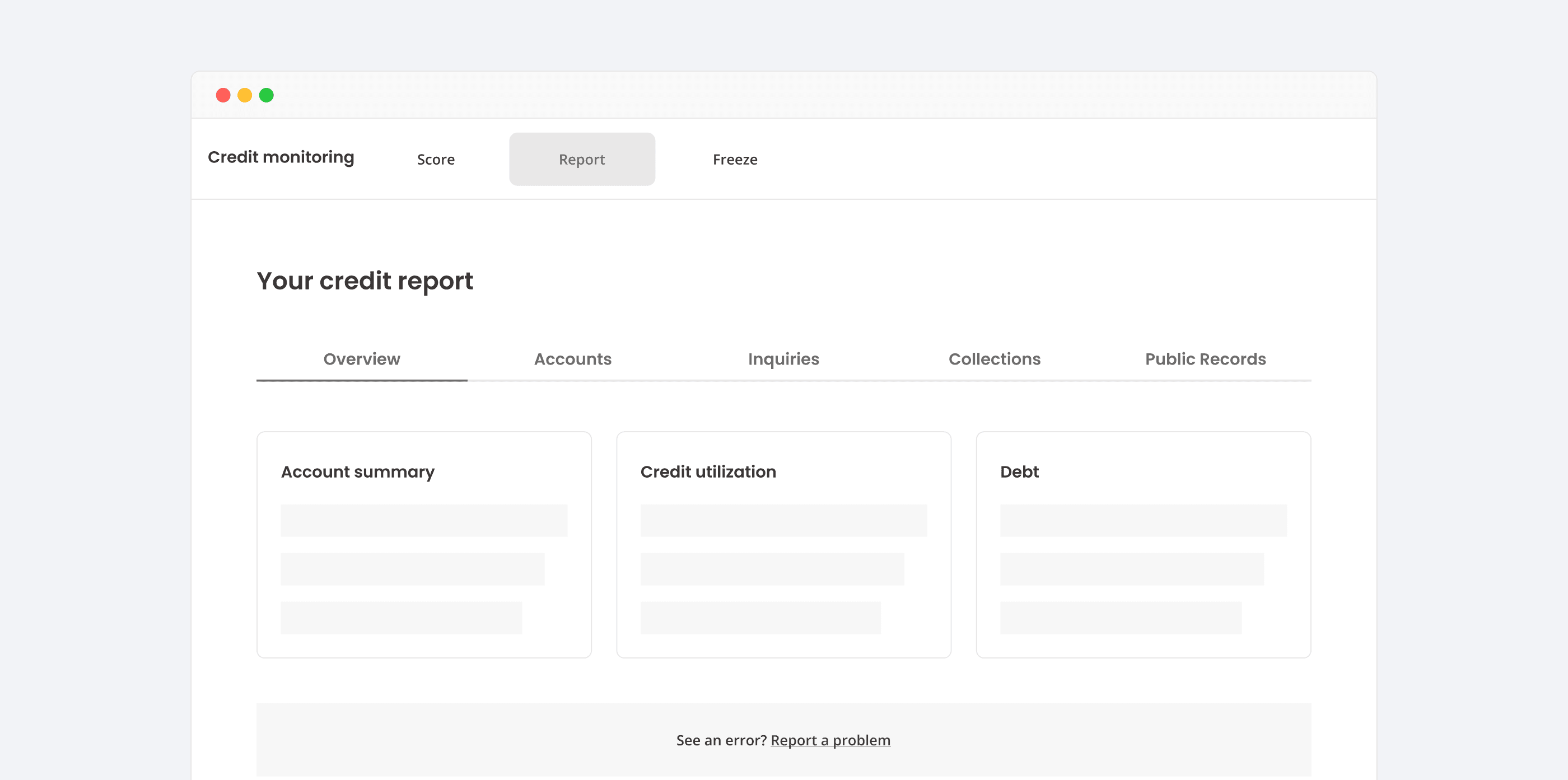

We chose a summary and progressive disclosure

This approach provided a concise overview for quick understanding, and reduced cognitive load by allowing users to access detailed information as needed.

Caption

Launch and learn

We launched with an MVP and gathered feedback to identify four areas for improvement:

Simplify the summary for better clarity.

Add section descriptions to enhance comprehension.

Chunk content to improve readability.

Introduce status tags to highlight potential issues.

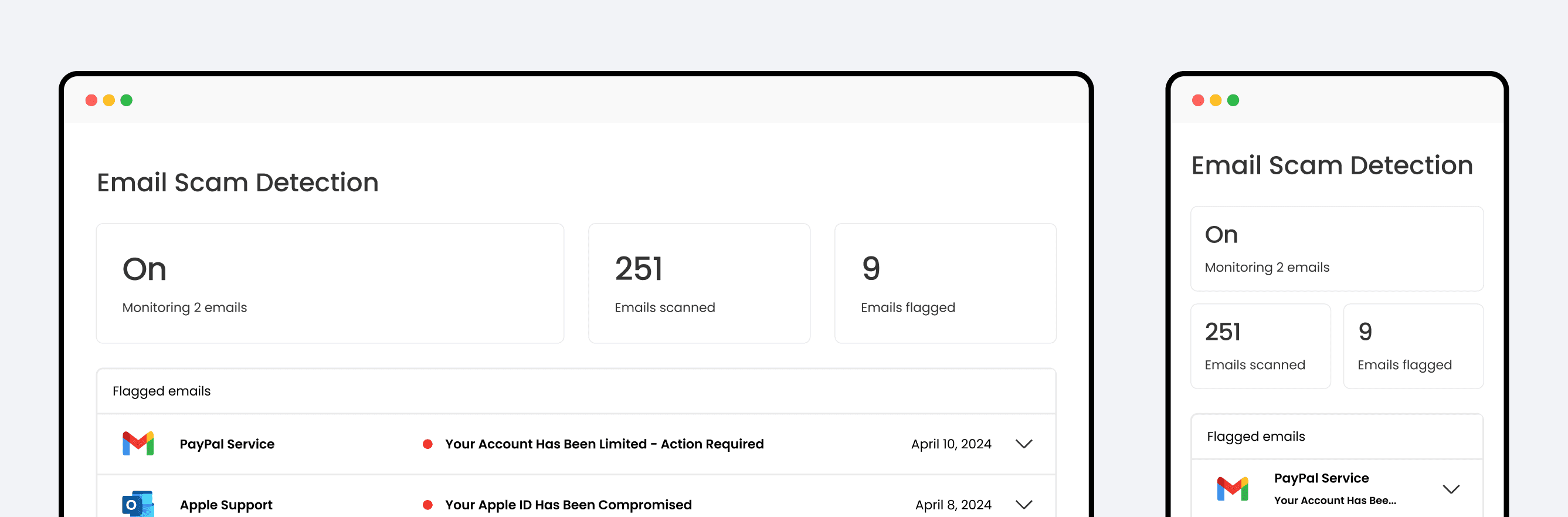

Final designs

After implementing the feedback we landed on these designs.

Caption

Caption

Caption